If you’re here because you’ve been Googling ‘1098 vs 1099’ nonstop, then you’re probably wondering about the difference between 1098 vs 1099 tax forms. We’ve got you covered! In this article, we will elaborate on the 1099 tax form vs 1098 topic, explaining the distinctions between the two tax forms and letting you in on all the nuances.

What Is a 1098 vs 1099: Brief Outline

You’ve most likely guessed that tax forms 1099 and 1098 are not the same and, naturally, they report different things. Form 1098 is used for reporting payments you made to someone else, while Form 1099 focuses on non-wage income you received. Both these forms aid you in keeping tabs of taxable profits and potential deductions. Now, we’ll get into the details on the form 1098 vs 1099 issue for you to be able to see the full picture regarding the differences between the two docs.

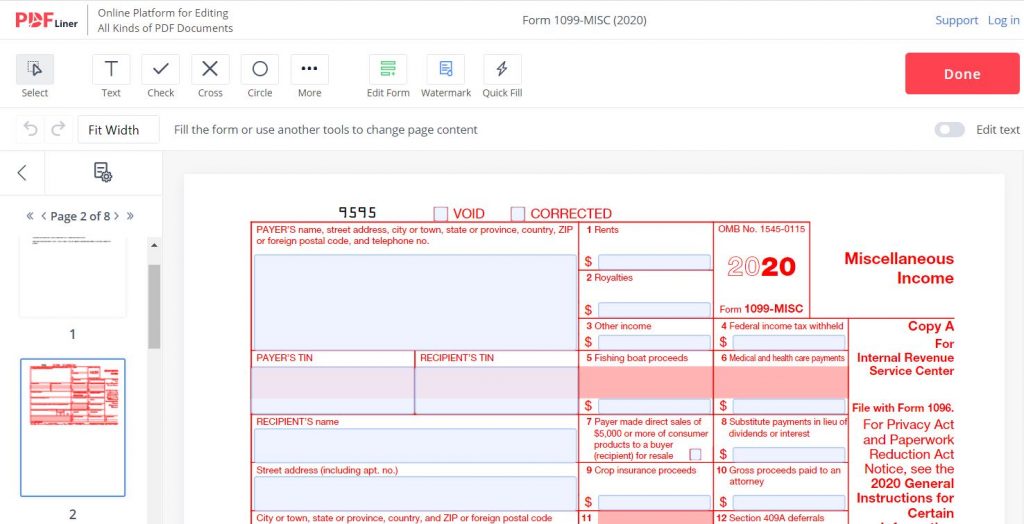

Let’s start with form 1099, its brief description and purpose. This form is represented by a range of documents the IRS dubs ‘information returns’. Form 1099 is utilized for reporting an array of non-wage income types, such as self-employment payments, government payouts, rental income, interest, dividends, etc. You can get form 1099, along with its variations, on the IRS site – as well as within our specialized portal.

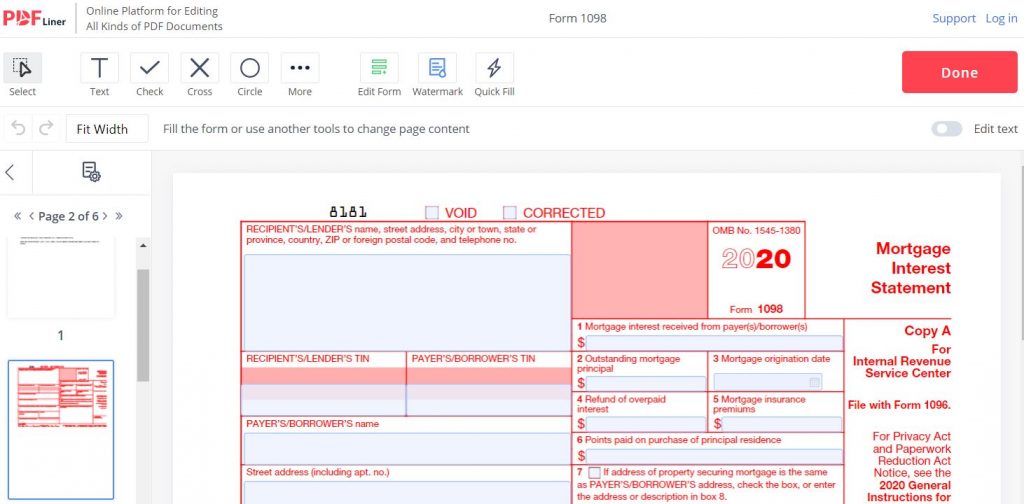

Now, with regard to form 1098, which is also referred to as Mortgage Interest Statement, it accounts for reporting the amount of mortgage interest a lender received throughout the current tax year. Also, the form usually includes additional charges, such as points, mortgage insurance premiums, etc. The lender must fill out and submit form1098 if the received annual amount is $600 or more.

Forms 1099-INT, 1099-Q, 1098-T & Other Types

Did you know that there are twenty variations of form 1099? If you’ve been Googling ‘1098 T vs 1099 Q’ or ‘1098 E vs 1099’ for some time already, then you’re aware of that. Form 1099-INT, for example, is utilized for recording income from interests. In other words, it’s a record that a bank or other entity paid you interest. If your earnings in interest from a bank or other similar institution are more than $10, a 1099-INT is going to land in your mailbox.

Wondering about the 1099 INT vs 1098 comparison? The difference between the two forms lies in the following: you’re going to need to submit a 1099-INT if your annual interest earnings are more than $10. If the annual mortgage interest amount you paid is $600 or more, you’re going to fill out and submit form 1098. Now, let’s switch from the form 1098 vs 1099 INT issue to other comparisons.

To help you make these comparisons, we will focus on a few variations of the 1098 vs 1099 tax forms. Find them below:

- 1099 Q is a must-submit if you used funds from Coverdell ESA or a 529 plan to finance your education;

- 1098 E is utilized for reporting your annual student loan interest;

- 1098 T is utilized by college students or their parents for reporting annual qualified tuition and college expenses (i.e. if they’re aimed at claiming certain education credits).

How to Properly Fill 1099 Tax Form vs 1098

Wondering how to sort out form 1099? This form features two copies: Copy A and Copy B. Use Copy A for reporting what you pay a freelancer to the IRS. The same details should be indicated in Copy B (and sent to the freelancer you work with).

Prior to approaching a 1099, don’t forget to collect all the necessary information regarding each freelancer you work with. This information includes:

- their full name(s);

- their contact details;

- their taxpayer ID(s);

- the total amount of income they received from you.

If you’re an entrepreneur who works independently and you receive Copy B of form 1099 from your customer, you’re not required to send it to the IRS. Just don’t neglect reporting the payments indicated in Copy B on your personal income tax return.

Now, with regard to completing form 1098, you’re going to indicate your general contact information in the upper left box. State the mortgage company’s federal ID number and the payer’s SSN in the appropriate boxes below the contact details. Put the borrower’s name and contact info, including their address. The boxes on the right must contain the specific amounts covered by the mortgage. Keep in mind that you can always ask your bookkeeper for help when it comes to filling out any tax form you come up with.

1098 vs 1099 FAQ

Have questions left about the tax forms discussed in this post? Can’t stop bombarding Google with ‘taxes 1099 INT vs 1098 E’ or similar queries? Find our answers to some of our readers’ most frequently asked questions on the topic below and enjoy advancing your tax education.

What is the difference between 1098 vs 1099?

Both forms are required to fill out your tax return. They aid you in keeping track of taxable income and possible deductions. Form 1098 is for reporting payments made to someone else, while form 1099 is for reporting your non-wage income.

Which form is used for a mortgage loan?

Out of the two main forms covered in this article, form 1098 is utilized for reporting the annual amount of mortgage interest received by a lender.