Upon the tax season’s arrival, all businesses are obliged to hand in tax reports to verify their tax-payment accuracy, including W-2 vs W-3. While Form W-2 acts as a direct employee income report, Form W-3 aims to support the former. It seems puzzling to some people, causing doubts and misstepping. Let’s get a grasp of what they are about and how to file them correctly.

What is a W-3 vs W-2?

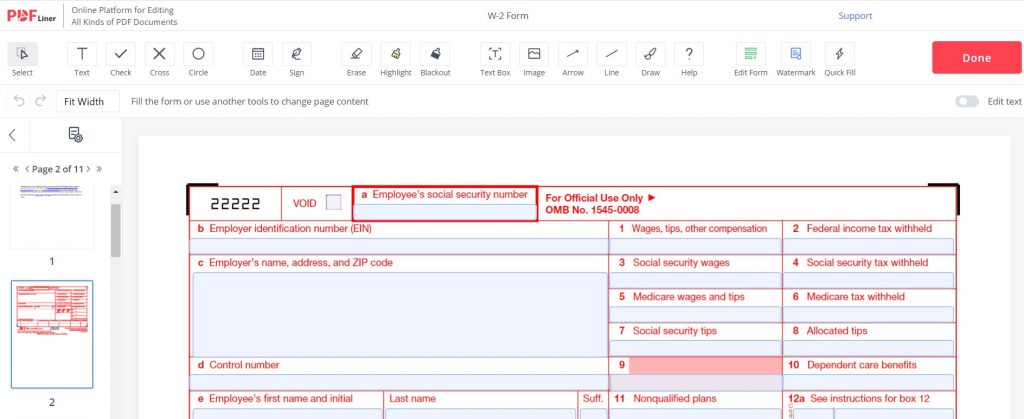

W-2 is a document used by the IRS to monitor your salary, compensations, and other information related to your annual income. Along with it, the form includes several lines requiring you to display withholdings applied to your income, as well as general taxes. The form is used specifically for full-time employees, who are officially registered and have a position at a company.

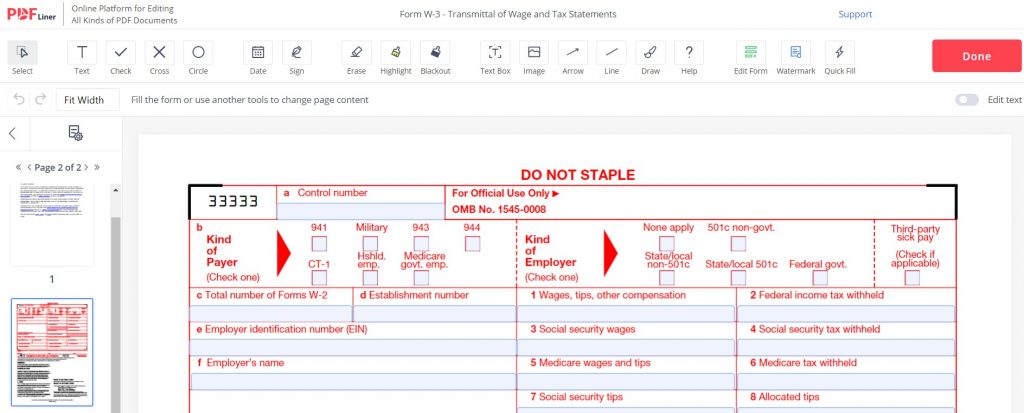

On the other hand, W-3 is a subsidiary document used to summarize your overall W-2 information. The form is filed by the employer and used for both internal, in-company accounting, and external, IRS monitoring. Although it doesn’t include the details of your original W-2 document, it gives a brief yet thorough overview of how well your taxes have been handled.

W-2 vs W-3 Form Taxes

Since the two forms have relatively the same, there is no difference in their taxation procedures. Moreover, a W-3 is not submitted to any other agency apart from the IRS and performs the ‘narrative’ part. It sums up everything designated on your W-2 form and is used to juxtapose the figures.

As for W-2, the governing law dictates that each employee submits the form with all the income and benefit-related information. This includes Medicare, Social Security, Employment, and other taxes. It’s hard to tell the exact tax rate you can anticipate from handing in W-2, but, for instance, the SS rate comes to around 7% of your income. This, of course, depends on your state, health insurance, financial capacity, and so on.

W-2 vs W-3 Household Employee vs Independent Contractor

If you are hands-on with taxes even a little, you must know that Form W-2 is a fillable document used only for full-time employees. Its sole purpose is to bind a worker to a certain business (employer) and report on their relationship as regards taxes. In other words, payments are processed through the employer’s payroll, which also includes annual and quarterly withholdings.

The same applies to W-3 giving an overview of the business relationship without getting too much into detail. This entails the company’s business name, EIN, address, all W-2 forms. Meanwhile, freelancers, i.e., workers who are not registered at the company, go under Form 1099 and Schedule C.

Filling Out W-2 and W-3

So the two documents are a reflection of each other and have a lot of things in common. For instance, there is no difference in W-3 box 4 vs W-2 box 4 since both of them require your SS tax. Nonetheless, there are some differences to consider while filing each of them.

W-2 (Employee)

- Write down your personal information such as the name, address, SSN, etc.

- Add your current taxable income, which includes wages, salaries, tips, etc. This refers to your overall income even if you have worked at the company for less than a year;

- Calculate taxes to withhold;

- Indicate the state income tax (if applicable) and local taxes.

W-3 (Employer)

- Type a worker’s status (941, Military, etc.) and add your company information (name, address, EIN, etc.);

- Designate a contact person and fax number;

- Add compensations, SS and Medicare wages;

- Include sick-leave and nonqualified plans;

- Report on the taxes withheld from each category;

- Sign and date.

W-3 vs W-2: Pros & Cons

Filing and submitting the two forms are essential to your company’s clear tax history. It’s highly unlikely that a business can function well if there is any misstepping with the IRS. Even though you must submit the forms anyway, you should know about the upsides and downsides that may come with each of them.

| Form | W-2 | W-3 |

| Pros | 1) Provides a full-spectrum overview of your income and income tax history (annually); 2) Confirms the full-time employment of a worker and backs up their Medicare and SS taxes; 3) Used for an annual tax return. | 1) Shorter and easier to file; 2) Doesn’t require the signature of an employee; 3) Provides a space for adjustments and federal tax withholdings; 4) Allows you to monitor the number of W-2s you have issued so far. |

| Cons | 1) Long to file and includes a lot of information to be designated precisely; 2)Requires both the employer and an employee to fill out; 3) High penalties for overdue; | 1) Used only as a summary, therefore, has no influence over income taxes; 2) Even though it has limited legal power, it’s still required for submission; 3) You need to keep it for the next 4 years. |

FAQs

Do you still have some more questions unanswered about W-2 or W-3? Take a look here to find the answers!

What is a W-3 vs W-2?

Both forms are used for annual income declaration, including salaries, wages, and other employment compensations. The latter is a fuller, more explicit document, which focuses mostly on a particular employee. Meanwhile, the former is used to give an overview of an employee but from the employer’s perspective. They are used together to expand the information of the two-party business relationship.

What is a W-2 vs W-3 vs W-4?

W-2 and W-3 are required for annual income tax withholding and applied to the current employees who are officially registered at a company. On the other hand, W-4 is used during the employment process to estimate the amount of tax to withhold after employment. In other words, you file W-4 to tell an employer how to withhold taxes when you file the subsequent W-2 form.

What is the W-2 form deadline?

Just like with other annual taxation documents, W-2 is to be submitted by Jan 31 each year. This implies that an employer must send a W-2 to their current employee but this date, whereas the latter will have to submit their W-2 by April 15.