Want to know the difference between forms 1040NR vs 1040 NR EZ? In this post, we’re going to elaborate on this topic in detail. Don’t forget that PDFliner is where you can find, edit, and complete almost any tax form, including 1040 NR and 1040 NR EZ. So read on and make the most of our portal to save your time (and money) like a pro.

1040-NR vs 1040NR-EZ: Brief Overview

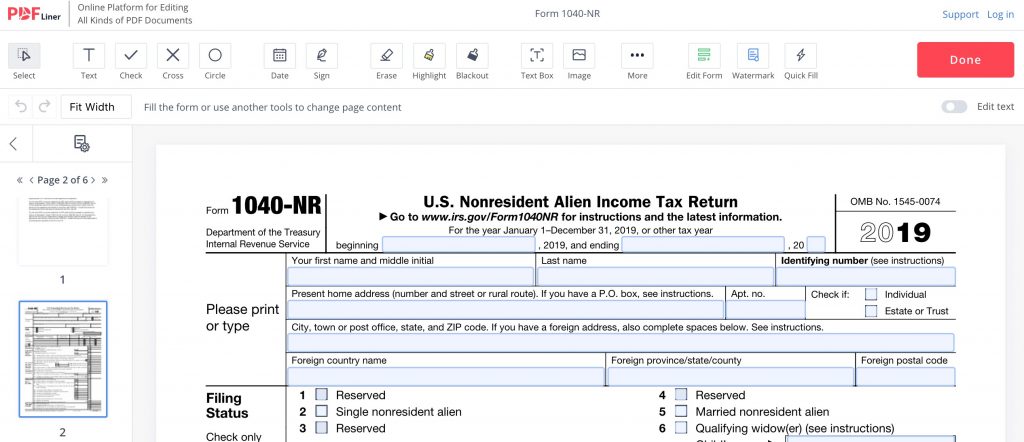

Let’s start with the form 1040-NR. This form should be filled out and filed to the IRS by those nonresident aliens who have been involved in any income-generating affairs in the U.S throughout the fiscal year. If a person who has to file this doc dies, the responsibility for this goes to their relatives or authorized representatives.

As a matter of fact, submitting form 1040-NR is less challenging than you may think. While lots of nonresident aliens think they’re not responsible for any taxes, they’re actually depriving themselves of a potential refund. Yes, certain entities may be withholding more from your paycheck, so make sure you sort the 1040-NR issue out to get your return.

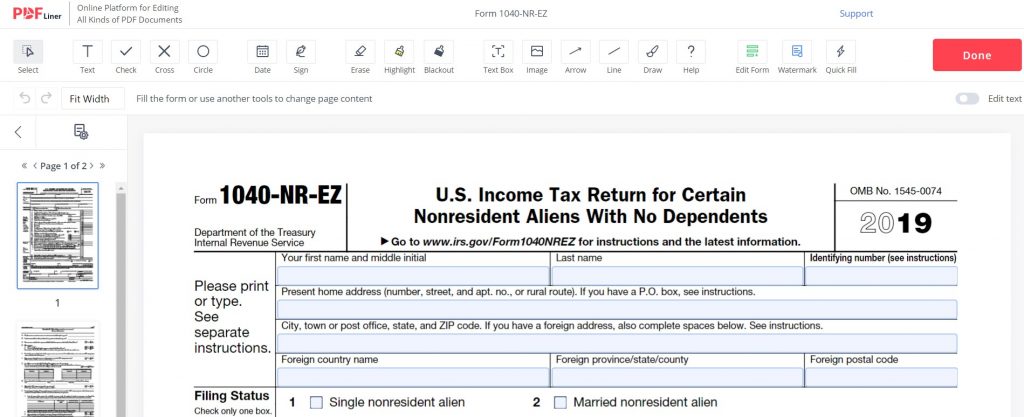

Now, when it comes to the form 1040NR-EZ, it’s represented by a more straightforward variation of the IRS tax return for nonresident aliens. You need to file the ‘EZ’ edition if your U.S.-based business affairs result in certain kinds of earnings (also known as ‘simple income’), e.g. scholarships, wages, tips, salaries, and the like.

If you’re dealing with the so-called ‘complicated income’ (e.g. earnings from an investment or a freelance project etc.), form 1040NR is what you should stick with. Basically, that pretty much answers your ‘difference 1040NR and 1040 NR EZ’ question.

Form 1040-NR and 1040NR-EZ Instructions

Wondering how to fill out the 1040NR-EZ form? The doc features two pages that ask for your personal details, such as your name, filing details, as well as income and immigration information. Keep in mind that the ‘EZ’ version does not feature details related to dependents, for this particular form is not meant for nonresident aliens with dependents.The 1040-NR is filled out in a pretty similar manner.

Keep in mind that if you come across any difficulties when filling out either of the forms we’re covering in this post, contact professionals for assistance. Alternatively, ask your bookkeeper to aid you with the completion process. Make sure you fill out the doc you’re responsible for correctly and always comply with the official deadlines to avoid potential sanctions or penalties. Browse through our blog for further advice on these or any other tax forms.

FAQ About 1040 NR and 1040 NR EZ

With a health savings account, do I need to fill out 1040-NR or 1040NR-EZ?

If you received distributions from a health savings account, then form 1040NR is what you should stick with. Feel free to ask us any further questions if you come up with any.

What’s the main difference between 1040-NR and 1040NR-EZ?

Both docs must be filled out by nonresident aliens. The difference between them lies in the type of earnings, as well as the need (or its absence) to claim dependents. Form 1040-NR is related to the so-called ‘simple income’ (see above for details), while form 1040NR-EZ is focused on the ‘complicated income’. The two docs are also different based on the way they’re filled out. Make the most of the PDFliner. Let us help you relieve your tax-related stress and make the fill-out process a lot easier.