The United States has a progressive taxation system. This means that the more a person earns, the more percent of their income they have to pay as taxes. The process of an annual tax refund is tricky, and it is quite easy to make mistakes when filing a tax return form. Which one should you use: 1040 tax form vs 1040-NR form? Let’s find out.

Form 1040-NR vs 1040: Overview

Many people are confused about these forms, so let’s clarify by distinguishing 1040 vs 1040-NR. Every year, thousands of non-resident aliens and residents file tax documents by mistake. In short, a resident must file Form 1040, and a non-resident must file Form 1040-NR.

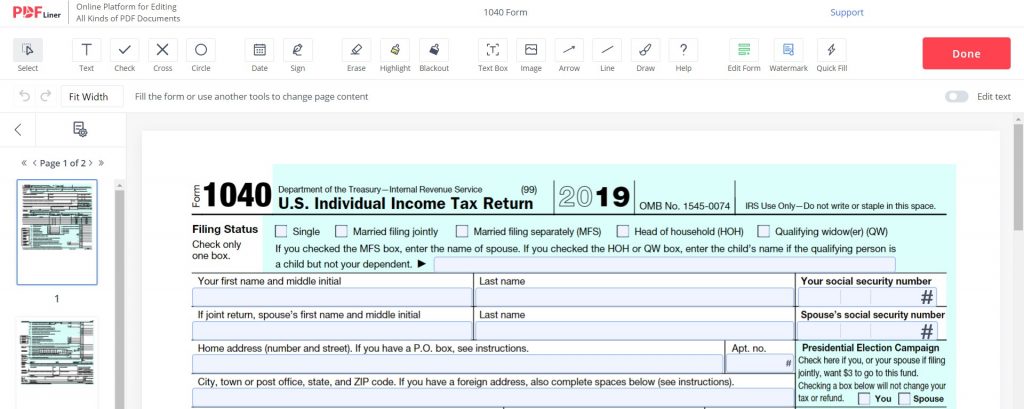

The 1040 Form is a key form required to complete the annual tax return. It is also sometimes referred to as simply 1040. There are also cases when you have to fill and attach different additional documents to the form. Each year, the IRS issues a new version of the 1040 Form.

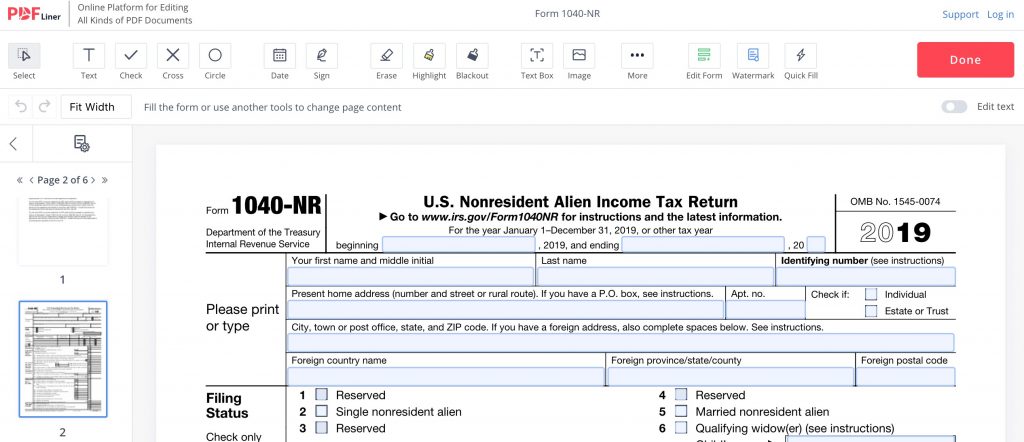

When it comes to the 1040-NR form, the IRS counts anyone who is not a US citizen, a green card holder, or has permission to stay and work or study, as a non-resident alien. However, if you have a business in the US and don’t live in any of the states, you also have to use this form.

Filling out 1040 Tax Form vs 1040-NR Form

To make sure you’ve prepared all the needed US tax documents, follow this checklist:

- Your residency status;

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

The IRS provides everyone with an opportunity to fill the tax return forms on their own. First of all, the main advantage of applying yourself is that it’s free. On the other hand, the main disadvantage is that you are the only one responsible for doing it by filing yourself. You should also remember that if you file the wrong tax return, you can be fined. You may even jeopardize your future US visa or green card.

However, filling the form 1040-NR vs 1040 doesn’t have many differences. You can download both forms on our site and see that you don’t have to be an expert to file any forms.

FAQ

Which form do I need: 1040-NR vs 1040?

Basically, Form 1040 is used by US residents, while Form 1040-NR is made for non-residents aliens. The rule is simple: if you get income from the United States, you must file a tax return.

1040 vs 1040A vs 1040-NR: which is which?

The 1040 tax return form is filled by the US residents to file an individual federal tax return. The 1040-NR is suitable for the non-resident aliens, and the 1040A is the form that should be used by people who fit under these criteria:

- Only IRA or having student loan adjustments to their income;

- Capital earnings distributions and no other capital gains or losses.

Also, using the 1040A form, you don’t have to itemize deductions.