What is W-8 vs W-9? If you’ve been Googling this question for a while now and want a comprehensive answer ASAP, you’ve come to the right place. In this post, we’ll elaborate on the W-8 vs W-9 tax forms comparison, focusing on their similarities and distinctions, as well as their purposes and different versions.

What is IRS W-8 vs W-9 Forms: Brief Outline

First and foremost, if you’re a U.S. citizen, you don’t have to worry your head over form W-8 at all. Here’s why. This document is usually completed by foreign individuals and companies that earn money from U.S. sources. According to the U.S. law system, foreign individuals or businesses who’ve received earnings in the U.S., are obliged to pay a 30% tax on a variety of income types.

Having said that, this rule has a few exceptions. The U.S. has an array of Income Tax agreements with a number of countries that imply reduced tax withholding rates for their citizens. Thus, by completing and filing the W-8 form, foreign individuals or companies declare who they are, confirm their place of permanent residence, as well as report the types of income they’re earned — all for the purpose of determining how they’ll be taxed.

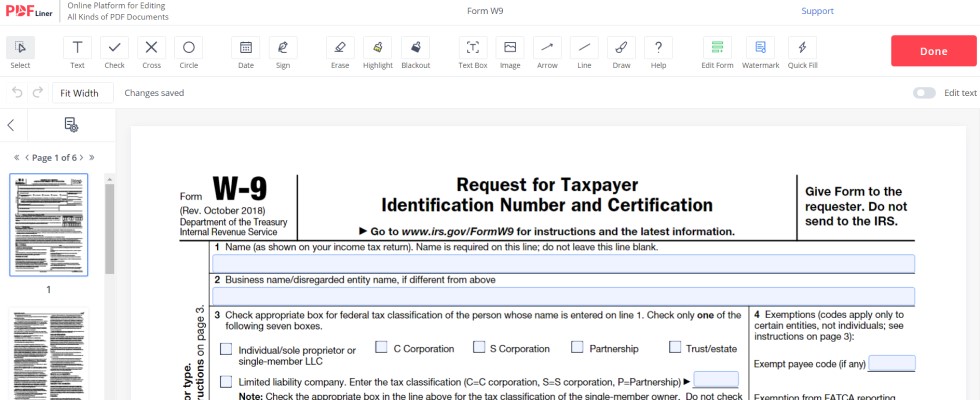

Now that we’re getting closer to clearing up the IRS W-9 vs W-8 issue, and you will no longer have to bombard your search engine with queries like ‘W-8 vs W-9 form’, ‘W-8 BEN vs W-9 amount’, and the like, it’s time to dwell upon form W-9 in more detail. So, if you run your own business or work as a freelancer, you’re most likely going to need to fill out form W-9, for your client to sort out their annual reports that include payments they’ve sent your way.

If you’ve been Googling ‘computershare Israel Bonds W-8 vs W-9’, ‘W-8ECI vs W-8-BEN or W-9’, or ‘W-9 BEN form vs W-8 BEN form’ for hours, you’ve probably heard that there’s a variety of (five, to be more precise) document types under the umbrella of a W-8. Find them below, along with brief descriptions:

- W-8 BEN: filed by foreign workers to verify their place of residence and potentially claim treaty benefits;

- W-8 BEN-E: utilized by overseas companies to confirm their place of residence and potentially claim treaty benefits;

- W-8 ECI, W-8 EXPL, and W-8 IMY: browse through our website to read about each of these forms in detail.

Useful Tips on Filling Out W-8 vs W-9 Forms

When it comes to the IRS W-8 vs W-9 form comparison, our tips on filling them out are similar:

- Be as careful and precise when completing the form;

- Read the whole form prior to filling it out;

- Make sure you use only black or blue ink when filling out the form (or better, use our website to avoid the annoying paperwork);

- Include all the proper certification, along with the signatures of all requested parties;

- Submit the form to the entity that has requested it (not the IRS).

Bear in mind that although forms W-8 and W-9 are issued by the IRS, they are submitted to entities that request them from you. You don’t need to file either of these forms directly to the Internal Revenue Service. Both forms must be submitted on time. If you fail to do that, you may experience a full 30% tax withholding, and even face penalties for filing after the deadline.

W-8 vs W-9 Tax Form FAQ

Have questions left about forms W-8 and W-9? Find the answers to our readers’ most frequently asked questions below. Need more details on the W-8BEN vs W-9 issue? Browse through our website or contact us for more info.

What’s the main difference between W-8 and W-9 tax forms?

The main difference between forms W-8 and W-9 is that the former is used strictly by foreign individuals and entities to confirm their place of residence for tax purposes, while the latter can be used by both resident aliens and U.S. citizens to verify their personal details and TIN for employment or similar income-receiving purposes. Both W-8 and W-9 tax forms are not filed to the IRS. You need to send them to individuals or companies that require them on time, otherwise, you may face penalties.

W-9 vs W-8 vs W-2: are they all alike?

Naturally, these three tax forms imply certain distinctions. However, they have similarities, too. For instance, neither of these forms is submitted straight to the IRS by individuals who need to fill them out. When it comes to the differences between the three forms, we’ll demonstrate them by defining form W-2. So, form W-2 is a document employers must send to their employees (as opposed to freelancers or foreign entities), and then to the IRS, to report their annual earnings, as well as the taxes withheld from their paychecks.