Tax forms can be confusing for anyone, especially if they have similar numbering. So that you don’t have problems and questions, in this article, we will tell you what is 1040-X vs 1040, help you determine the difference between them, explain what they are for, and how to fill out each of them.

IRS 1040 vs 1040-X: Basic Info

In short, Form 1040-X is used to supplement information from Form 1040. Why and when you may need this, read below.

1040-X form vs 1040 form

Form 1040 is the main document used by individuals (US citizens) to declare their income and deduct related taxes. The last version of it appeared recently and combined three forms that were used earlier. It has become simpler, but the IRS added several applications.

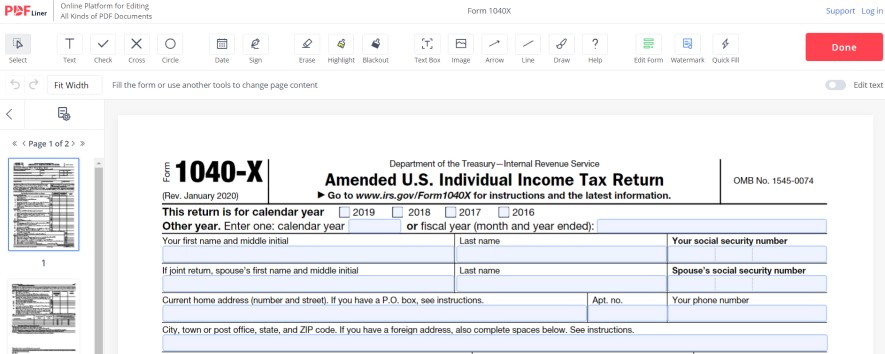

Form 1040-X is needed so that you can make adjustments to the information on Form 1040. As you understand, it is filled out only after the submission of the main document 1040 and only if errors were made.

Tax form 1040-X vs 1040

In Form 1040, a US citizen, in addition to personal information, must indicate all of their income for the past year. This way, the tax office can determine if a taxpayer should receive a refund, or they will have to bear the liability. It is determined by the difference between your total tax and total payments. Tax returns must be filed with the IRS no later than April 15th.

If you have made mistakes when filling out this document, you can correct them using Form 1040-X. Please note that you will need to attach documents confirming the new data in addition to this form.

1040-X vs 1040-A vs 1040

As we already found out when comparing 1040-X amended return vs 1040, the 1040 form is the most comprehensive document that all individual taxpayers must fill out. Form 1040-X can be considered an attachment if errors were made in the previous document. It is a significant difference between tax 1040 vs 1040-X.

Previously, there was also Form 1040-A, which was a simplified version of 1040 with a limited number of revenue lines. It had to be completed by those US citizens whose total income for the tax year did not exceed $100000. Since 2018, Form 1040-A is no longer used. It was replaced by the new version of 1040.

Let’s Fill Out IRS Form 1040 vs 1040-X

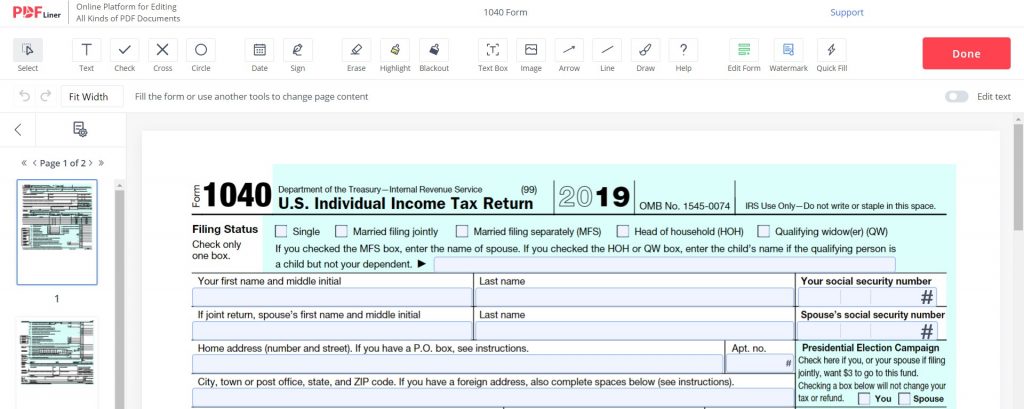

Form 1040 is a two-page document. On the first page, you should include your first name, last name, social security number, status, address, as well as the details of your spouse and dependents. The second page is devoted to your income and the corresponding tax calculation. You can submit this document to the IRS in paper or electronic form.

Many lines are repeated in the 1040-X form. What is convenient, a taxpayer may not fill in all of them, but enter only the information that has changed. You will have to explain the reason for making the adjustments and attach documents that confirm the new information. So, for example, if your income/tax ratio has changed, you should pay the difference and attach a 1040 V for 1040-X form as proof of debt repayment. This form can only be completed and submitted to the tax office in paper form. Remember that the IRS releases new versions of all forms every year, so stay tuned.

FAQ About 1040 vs 1040-X Tax Return

1040-X amended tax return vs 1040: which form is right for the procedure?

To do this, you must fill out Form 1040-X. A taxpayer has the right to request an amended return within three years after completing and submitting Form 1040 to the IRS. You should complete this document if you realize that you did not report one of the income, or your circumstances changed before the end of the tax year for which you were reporting.

Which of 1040 vs 1040-X is a FAFSA form?

If you are a student requesting Free Federal Aid (FAFSA), you will need to provide personal information, including proof of your financial condition. Which form 1040 vs 1040-X FAFSA requires to file? You will need to fill out Form 1040, which will ask you to list all sources of your income. Once this information has been passed on, you cannot make changes using the 1040-X form.

Is 1040 V a 1040 series or 1040-X series?

Form 1040V is a supporting document. It simply confirms that you have paid the outstanding debt, which was indicated in the 1040 form. By and large, you do not have to fill it out; you just need to pay the resulting difference between your total payments and total tax.