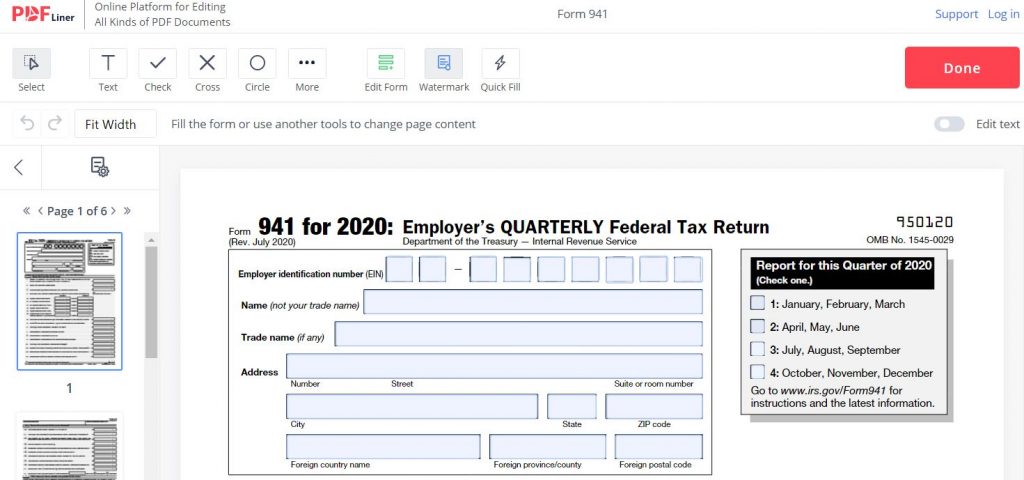

IRS 941 form is known as Employer’s Quarterly Federal Tax Return. This form is used by employers to clarify the federal income they provide, as well as taxes on Medicare that were withheld from the salary of the employee, and Social Security. The W-3 form is a broader document that must be filled with the wages and withholdings on Social Security from employees. Unlike the W2 form, it reveals common numbers for all your employees.

Form 941 vs W3 Overview

Form 941 reveals the information on the amount of money you withheld from your workers every quarter. The money you take is the money that covers Social Security, income taxes, and Medicare. If you are wondering about the difference between on w3 941 vs 944, the 944 form is an annual stats, while 941 is quarterly. You use 941 forms four times a year.

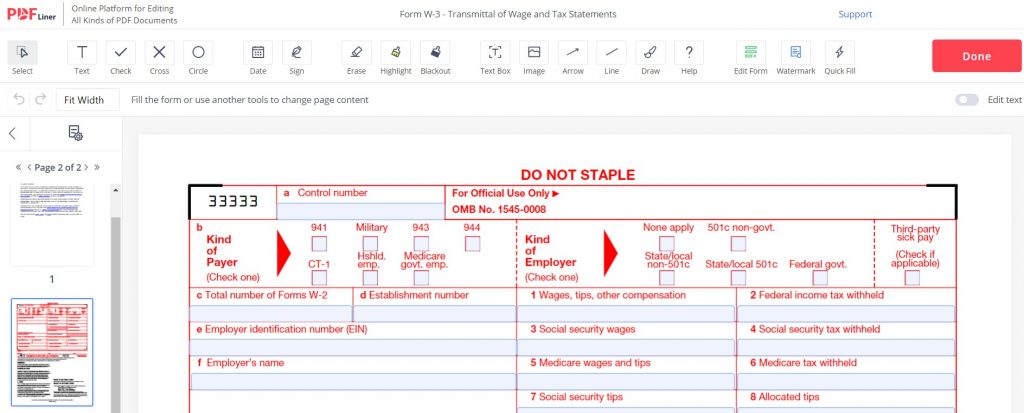

W3 is a specific document about withholdings on Social Security from employees. It is an annual document. You have to include numbers from the 941 form if you are that Kind of Payer. This form is filed by most employers in the private sector.

Tax Form 941 vs W-3

Main differences:

- W3 is an annually reported form on Social Security withholds from employees, signed by the employer;

- 941 is a quarterly based report on withholdings from Social Security, Medicare, tax income from employees to employer;

- You don’t require a W3 form while filing 941 form, but you need to use the data from the 941 form while filing Box B of W3;

- Both forms can be emailed to IRS online;

- In general, all the business with employees requires 941 form, with few exceptions like seasonal works, household employees, and farm employees.

IRS Form 941 vs W-3

Let’s quickly learn how to fill both of these forms. Here is a step by step instruction that every employer must learn. If you are an employee, you may want to know about both forms as well.

Filling 941 forms:

- The form must be filed until the last day of the month at the end of the quarter. If the quarter ends April 30, the form is due by May 31. However, there are national holidays that must be considered;

- State the wages that you paid your employees;

- Amount of withheld federal income;

- The life insurance premium paid for the employees;

- Paid sick leaves;

- Earned tips;

- Share that belongs to employees on Social Security and taxes on Medicare;

- Indicate possible quarter changes or adjustments;

- If you withheld additional tax on Medicare from your workers, point it out as well.

Filling Out W-3:

- Choose which Kind of Payer you are. Based on this information, you may need to point out the 941 form;

- Which Kind of Employer you are;

- Indicate the number of Forms W 2;

- Identification Number of Employer and your name;

- Fill the data on the wages, tips;

- Social Security and Medicare wages in separate columns.

FAQ

Read the answers before you start filing these forms. Make sure you understand the difference between them. If you have your personal recommendations, you can share them in the comments.

What are the main 941 vs W-3 differences?

Form 941 is widely used for employers from the private sector. It states the amount of taxes withheld by you from employees every quarter. It includes Medicare and Social Security wages. You have to point out that you are using this form while filing the W3 form in the column Kind of Payer. Sometimes you can switch the 941 form with 944 form, but you still have to fill W3. W3 is an annual form, while 941 is a quarterly report.