Forms 1099 and 1040NR are sometimes confusing. While both of them are here to reflect your income, the 1099 is a general one, and the 1040-NR is just for a certain part of them. Here we explain which form is which and how to tell which your income sources should be reflected in this or that one.

What Is 1099 vs 1040-NR?

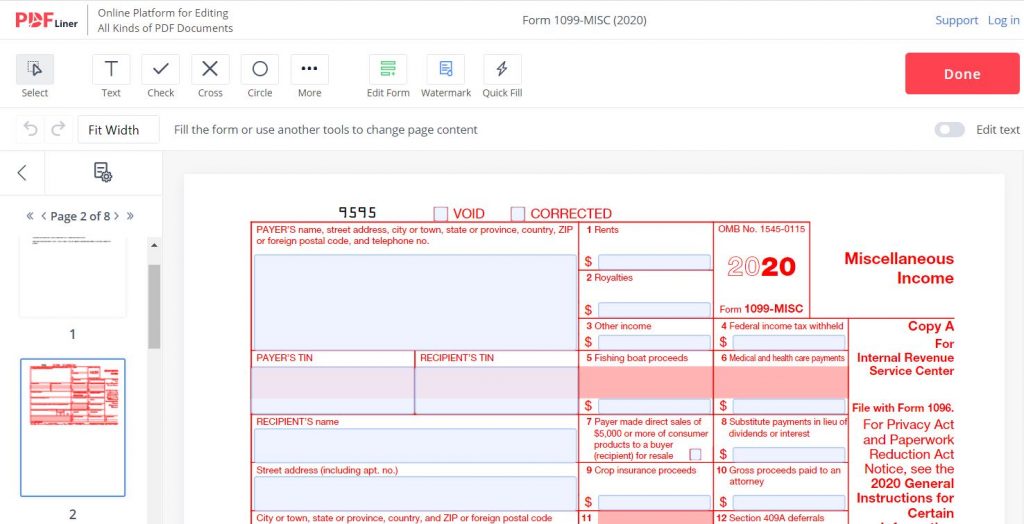

IRS 1099 is one of the most necessary IRS forms for any client or customer who has ever contracted other persons or companies for some service. It is designed to be initially filled by the client who then sends its copies to the IRS and to the State Tax Department (if it’s required). One copy should be sent to the contractor (person or company who got paid for the service).

Finally, the payer leaves one copy for themselves. The payee doesn’t have to interact with the 1099 they receive from the payer. But, as they fill and file their own 1040 when reporting their annual income.

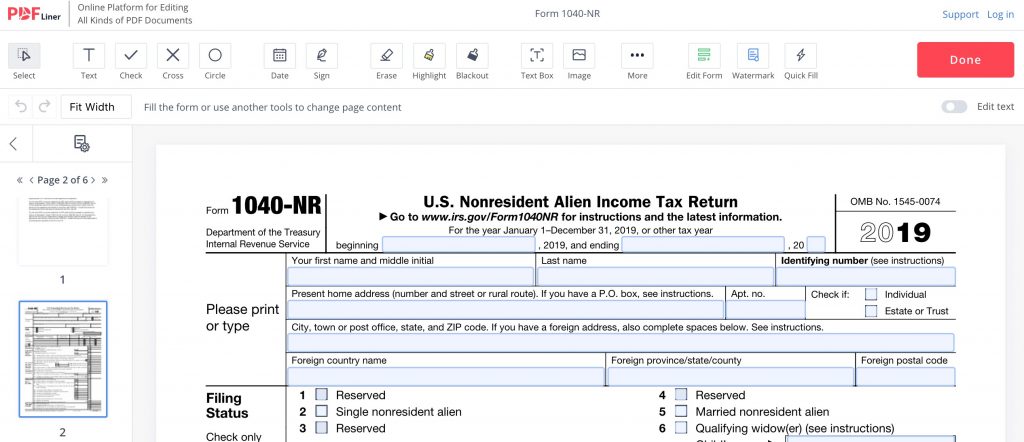

The 1040-NR is, on the contrary, a version of 1040. It is to be filled by some taxpayers who have received income from contracts with the US citizens or companies and now have to return tax from it. The NR is for “non-residential”. So 1040-NR is to be filled and filed by nonresidents who were engaged in financial activity in the U.S.

It makes little sense to compare 1040NR vs. 1099. They aren’t mutually replaceable in any way. It’s more logical to compare 1040 and 1040-NR, but they are, on the contrary, rather similar. Resident aliens, though, are supposed to fill and file the generic 1040.

Form 1099 vs 1040-NR instructions

Let’s see the situation when you really have both of these forms on your hands. So let’s suppose you’re a nonresident and you have been contracted by the U.S. payers during the financial year. You have received $600 or more, so 1099 is required. So how do your 1099 and 1040-NR interact?

- Your payer has to send you your copy of 1099 within one month since the end of the financial year (usually January 31).

- When you receive it, you need to reflect the income reflected in it in line 62a (in Payments section). You don’t have to specify the exact sum for each of your 1099 if you have had multiple contracts.

- Attach all the 1099’s you have received from your payers. It’s necessary if a tax was withheld from these payments.

- Fill the rest of your 1040 according to your income.

- File your 1040 before the due date (usually June 15).

That’s how the 1099 you receive and the 1040-NR you file are connected. The instructions are updated by the IRS yearly or as soon as the law is updated.

FAQ

1099 vs 1040-NR: which form to choose?

There’s no situation where you need to choose between these two. If you have contracted other persons or companies for some services (not hiring them constantly), you need to reflect what you have paid them during the year in the 1099. The 1040 (and its NR version) is meant to reflect the income you have received.

Some nonresidents are still supposed to file the regular 1040. How do I choose between 1040 and 1040-NR?

To be considered a resident alien who is supposed to file 1040, you need to meet the green card test or the substantial presence test. Otherwise, you need to file 1040-NR.